Stop guessing, start listening: The case for market research in branding.

.gif)

Stop guessing, start listening: The case for market research in branding

There’s a familiar image that lingers in the branding world: Somewhere in a quiet studio, a lone creative sits hunched over a sketchpad (or these days, a Figma file), sketching out brilliance. In a haze of inspiration, they conjure a brand that is so elegant, so perfectly formed, it simply must succeed. A solitary genius who doesn’t need outside input because brilliance, after all, speaks for itself.

Except it doesn’t. Not always. Not even often.

This narrative sticks because it flatters the creative process. It suggests that with enough talent, any idea will simply work. But in reality, branding rarely thrives in isolation. A logo that gets a standing ovation in the workshop might land with a thud in the real world. Internal excitement doesn’t guarantee external relevance.

Which brings us to the uncomfortable—but essential—question:

Do we need market research, or do we already know what makes our brand special?

It’s a fair question. After all, no one knows your brand like your team does. But branding isn’t about you. It’s about what other people perceive, understand, and feel. And that’s where research can be the bridge between intention and impact.

So let’s take a closer look at why market research might be worth your time, when it’s overkill, and how to approach it without killing creativity.

Branding is about identity—but whose?

When companies set out to (re)define their brand, the first question is usually: Who are we? Cue the mission statements, brand archetypes, value definitions, and purpose pyramids. There’s no shortage of frameworks to help articulate a brand’s identity. But identity is only half the picture.

It’s easy to assume that what you say about your brand is what people hear but what you intend to communicate isn’t always what’s received. This is the classic confusion between brand identity (what you want to project) and brand image (what people actually perceive). A brand might believe it’s coming across as premium, while customers see it as overpriced. You might aim for bold, but the outside world hears aggressive. Without research, you might never know.

Think of it like getting dressed without a mirror. You might feel confident walking out the door—but step outside and everyone’s politely averting their gaze because the colors of your outfit clash, your collar’s flipped, and you’ve got spinach in your teeth.

That’s what brand research does: it holds up a mirror. It reflects how people actually experience your brand—not how you wish they did. Sometimes that reflection is flattering. Other times, it’s a much-needed wake-up call.

What market research really means in branding

Let’s clear up a common misunderstanding. Say «market research» and most people picture dense spreadsheets full of purchase intent data, bar charts or massive surveys about product features.

That’s not the kind of research we’re talking about.

In branding, market research is about meaning, emotion, and culture. It’s about understanding people—not just as data points or consumers, but as full humans with contradictions, values, fears, and desires.

Not all research is created equal

There’s a big difference between measuring what people do and understanding why they do it. That’s where the distinction between quantitative and qualitative research matters.

Quantitative research gives you breadth.

Think of it as the wide-angle lens of market research. It won’t zoom in on the why, but it gives you a panoramic view of how many people think X, prefer Y, or choose Z. It’s especially useful when you want to validate assumptions, track shifts in perception, or measure awareness. Quant won’t tell you what keeps your customers up at night, but it will tell you whether 67% of them associate your brand with ‹innovation› or think your new logo looks like a fintech startup from 2009.

It’s also your best bet for spotting patterns across different segments. Are loyal customers picking up on something that first-time buyers aren’t even seeing? Is that messaging tweak hitting home with Gen Z but falling flat with everyone over 40? These aren’t just nice-to-know stats—they’re the kind of insights that show you what’s working, what’s not, and for whom. It’s where quant earns its keep: revealing the patterns you’d otherwise miss.

What quantitative research could look like

Depending on the budget and timing, you can go the classic route—custom survey design, fielded properly, with enough participants to draw conclusions—or take a more synthetic approach using existing panels or third-party tools. Both are valid—as long as you're clear on what you're trying to learn. Here are some of the most useful tools in the quantitative toolkit:

- Brand tracking surveys: Structured surveys run at regular intervals—monthly, quarterly, or annually—to track key brand metrics like awareness, preference, trust, and associations. They help you see whether your brand is gaining traction, slipping behind competitors, or just treading water. Think of it as your brand health check-up.

- Trust segmentation: In close collaboration with seasoned researchers—like our long-time partner Prof. Dr. Eric Eller—we approach trust as something measurable and segmentable. Through custom survey modules, we explore how it shows up across different customer types, product lines, and brand interactions. It’s not just a question of whether people trust you, but where they do, where they don’t, and what that means for how your brand shows up.

- A/B testing: When internal debates stall at «Team Headline A vs. Team Headline B,» quantitative testing can be your tie-breaker. A/B testing lets you compare different versions of messaging, visuals, or campaign concepts in the real world and see what actually resonates before rolling it out at full scale.

- Synthetic quant methods: Tools like rapid polls, Google Trends, or digital behavioral analytics (think clicks, scrolls, bounce rates) can offer quick, directional input. They won’t give you statistically bulletproof insights but it’s often good enough to decide.

In short: quantitative research won’t give you the poetry of your brand story—but it will give you the punctuation marks. The commas, the question marks, the full stops that tell you when to pause, pivot, or push forward.

Qualitative research gives you depth.

When it comes to branding, numbers alone only tell part of the story. Branding isn’t built solely on bar charts and statistical significance—it lives in emotion. It’s shaped by gut feelings, first impressions, and the kinds of unspoken associations people often can’t articulate in a survey. That’s why qualitative research is so often valuable when you're trying to (re)build a brand. It helps you tap into the mental and emotional context behind the numbers—how your customers think, what they care about, and how your brand fits into their worldview. It’s less about measuring and more about understanding.

What qualitative research could look like

- In-depth interviews: One-on-one conversations that go far beyond «Do you like this ad?» They’re designed to explore what people really value, believe, and feel—even when they’re not quite sure how to express it. It’s less about opinions and more about motivations, language, and worldview.

- Ethnography: Research in the wild. Instead of asking people what they do, you watch what they actually do—how they use a product, how they talk about it, where it fits into their routines. What people say and what they do often don’t match, and ethnography helps you bridge that gap.

- Semiotic analysis: Decoding the cultural signals embedded in your brand’s language—visual and verbal. What does your color palette suggest about your values? What does your tone of voice signal about your attitude? People read brands in seconds, long before they process a single line of copy. Semiotics helps you understand the meanings they absorb without even realizing it.

In short: qualitative research won’t give you the full script—but it will give you the voice. The tone, the subtext, the unspoken cues that tell you how your brand is really being heard and how to make it resonate.

The three key phases of branding and where research makes all the difference

Branding isn’t a one-off moment; it’s a process. And just like any good process, there are key points where pausing to ask the right questions can save you from heading in the wrong direction.

1. Before you create: Make the invisible visible

This is where foundational decisions get made. It's tempting to jump straight into visuals and copy—after all, that’s the fun part. But before the first moodboard is built or the first headline written, you need to understand the landscape you’re stepping into.

There are three essential goals in this phase:

- Understand your audience beyond personas: Generic personas like «Sophie, 32, loves yoga and matcha lattes» won’t help you. Real audiences are layered and often contradictory. To connect with them, you need to move beyond demographics into values, worldviews, and cultural context. Great research at this stage helps you move from assumptions to understanding—from who they are to what matters to them.

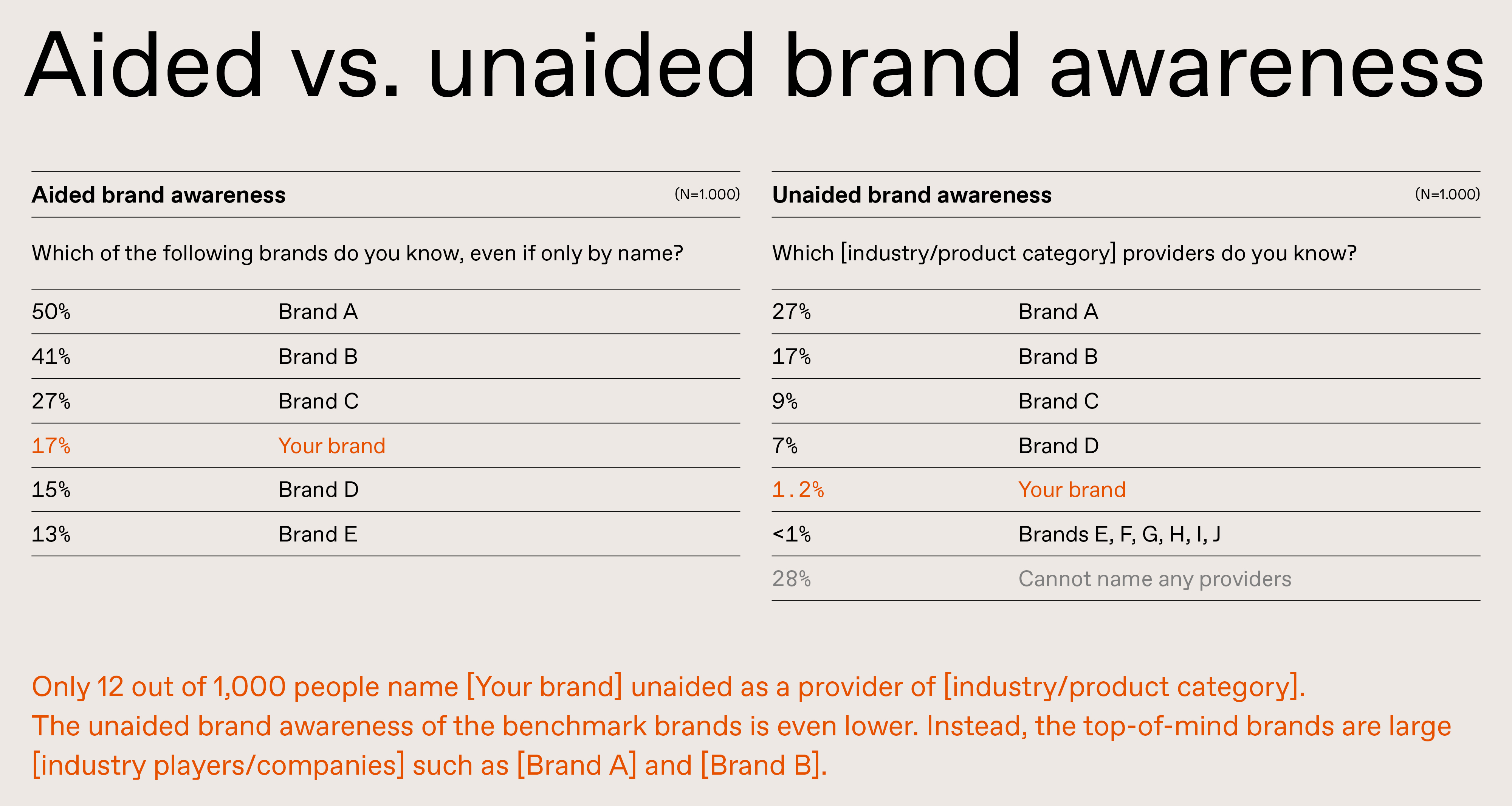

- Run a baseline check: You can't measure growth—or change—without knowing your starting point. What’s the current perception of your brand? Do people associate you with quality, value, credibility? Do they register you at all? A baseline gives you a reality check on where you stand and helps you see how far your brand needs to move, and in what direction.

- Identify trust gaps: Trust isn’t something you can claim in a headline. It’s something people grant you—slowly, and on their terms. Research helps you figure out where that trust is fragile or broken. Is there skepticism about your category? Do people see you as credible, or as another faceless player? Once you know the fault lines you can build a brand that addresses those concerns, rather than ignoring them. You can’t fix trust issues you don’t know exist.

Skip this phase, and you're building blind. You risk pouring time, money, and energy into building a brand on shaky assumptions and designing solutions for problems your audience doesn’t have. This phase is where you set the direction. Get it right, and everything downstream becomes sharper, more focused, and more resonant. Get it wrong, and you risk building a beautiful brand that no one quite relates to.

2. During development: Test, learn, and spot blind spots

Once the ideas start flowing it’s easy to get attached. After all, you’ve put thought, time, and creativity into them. You see the cleverness. You feel the potential. But here’s the problem: love, as they say, is blind—especially when it’s your own work.

This is where research steps in—not to kill your darlings, but to make sure they’ll survive outside the walls of your team meeting. It doesn’t exist to tell you whether your ideas are good or bad. Branding isn’t a multiple-choice test, and research isn’t about passing or failing: it’s about resonance. Do people understand what you’re trying to say? Do they care? Does it challenge them in the right way—or rather confuse them?

3. After the launch: Learn, don’t just validate

Branding doesn’t end when the website goes live, the packaging hits shelves, or the campaign drops. In fact, that’s when the most valuable feedback starts rolling in. Your brand doesn’t come to life in a deck or on a launch stage. It starts breathing only when it hits the real world—when actual people start seeing it, reacting to it, talking about it. Post-launch research is where you discover how your brand is being lived, not just how it was designed. What’s landing? What’s misunderstood? Where is there friction or surprise?

Sometimes the feedback tells you you’re right on the money. Other times, it points out blind spots you didn’t even know existed. Either way, this post-launch phase is where your brand stops being a static »ta-da!« moment and starts evolving into a living, breathing system—one that gets sharper, clearer, and more relevant over time. And let’s not forget: perception doesn’t shift overnight. Case in point—a true story from our own orbit: An investor recently told us he was floored by a company’s rebrand (he even called it the best pitch deck he’d ever seen). He started following the brand immediately—but didn’t invest until three years later. Sometimes, even when you’ve made the right impression, people need time to catch up. Branding is a long game—and research helps you play it smarter.

The trap to avoid: Using post-launch research as validation instead of learning

After months of hard work, it’s natural to want affirmation. To look at post-launch research as a way to confirm that everything went according to plan—that the brand landed exactly as intended. A well-earned pat on the back. But if your only goal is to say «See? We nailed it,» then you’re not learning—you’re just telling yourself a story. That’s not research; that’s retroactive rationalization. This mindset may feel safe, but it quietly shuts down curiosity. And when curiosity goes, so does growth.

The best brands don’t just launch and leave. They listen. They refine. They understand that when something doesn’t land exactly as intended, it’s not a failure—it’s feedback. That’s how good brands become great: not by getting everything right the first time, but by staying responsive, relevant, and engaged over time.

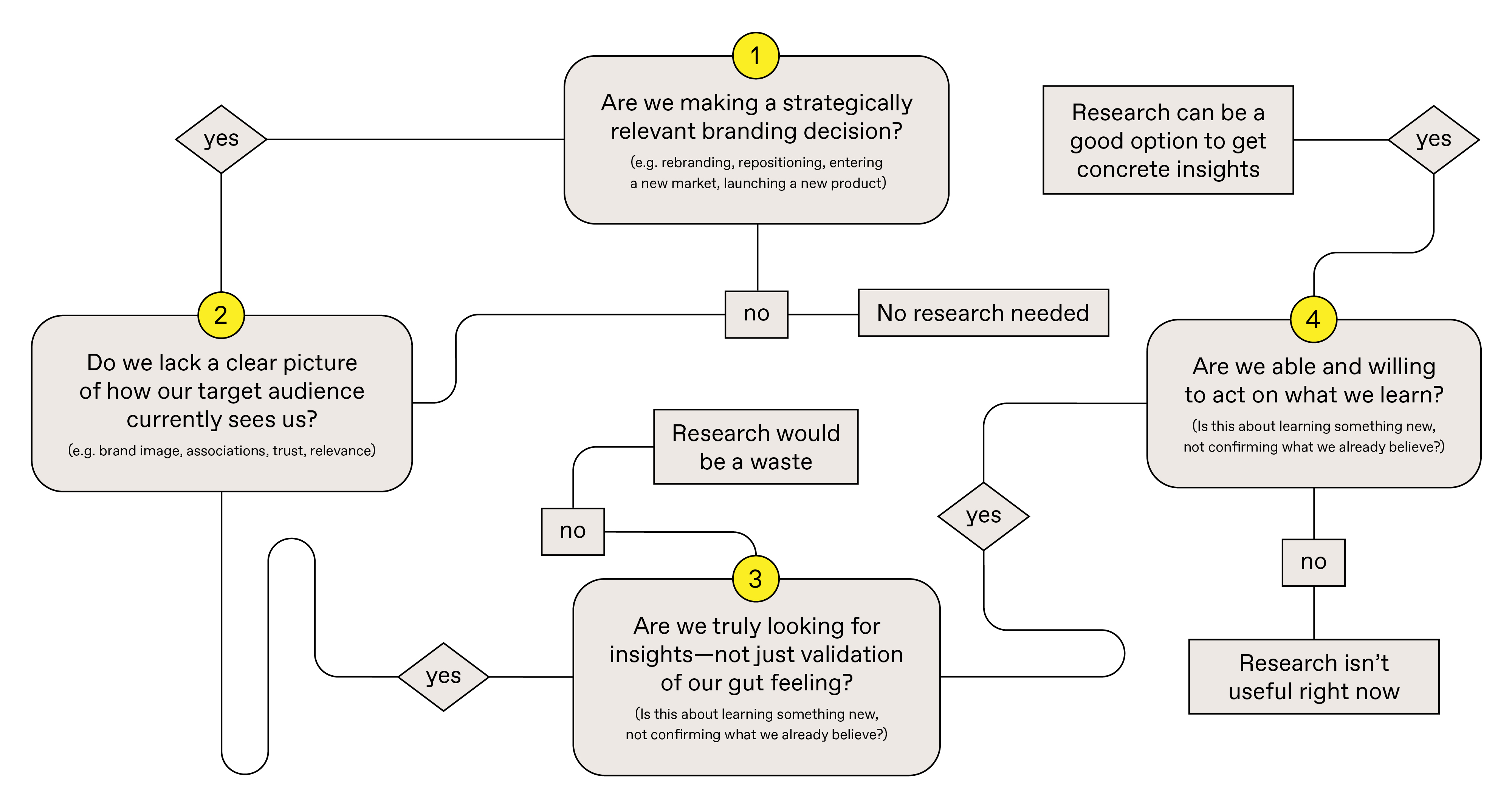

When you can (and should) skip the research

We’ve made a strong case for why market research matters in branding—and it does. But here’s the reality: not every branding project needs a research phase. There are scenarios where it’s smarter to skip the deep dive and move forward with what you’ve got.

Here’s when you might give yourself a pass:

- You’re in a small niche and already close to your customers. If you operate in a tight, well-defined market and regularly talk to your audience, chances are you already have a strong grip on what they care about. In these cases, your instinct is informed by real interaction, not just internal assumptions.

- You don’t have the capacity to act on insights. If you’re constrained by budget, timing, or team alignment, then even the best insights will collect dust. Research only adds value when it has the power to influence decisions.

- You’re doing research just to tick a box. Running a few interviews or surveys just to say you did research—without any intention of using the findings—is a waste of time and money for everyone involved.

- Your research design is flawed from the start. Leading questions, unrepresentative samples, unclear objectives—poorly executed research won’t just fail to help, it can actively steer you in the wrong direction. In these cases, bad research is worse than none at all.

What to keep in mind when you want to do it right

You don’t need a big budget or a full-time insights team to run meaningful market research. What matters most is how you approach it. Here’s how to keep your research effective, focused, and genuinely useful:

- Small and deep beats big and shallow. You don’t need a massive sample size to learn something meaningful. In fact, ten real, smartly sourced conversations can reveal more than a hundred checkbox responses. Look for depth, not volume.

- Design for action. Research isn’t valuable unless it leads to a decision. If you can’t complete the sentence «Because we learned X, we will do Y,» then the insight is just interesting trivia. Make sure every question you ask ties back to something you can act on.

- Aim for clarity, not certainty. Research isn’t a crystal ball—it won’t tell you exactly what to do, guarantee outcomes, or eliminate risk. What it can do is point you in the right direction. It offers signals, patterns, and perspectives that help you move forward with greater clarity and confidence.

- Beware of paralysis by analysis. Too much research can quietly sabotage progress. If you find yourself endlessly validating and re-validating—chasing absolute certainty before making a move—it’s a sign you’re stuck. At some point, you have to stop researching and start deciding. Because insight without action is just noise.

Final thoughts: Branding is a dialogue—not a monologue

It’s time to let go of the idea that research gets in the way of creativity. Done right, research doesn’t limit the creative process—it strengthens it. It gives creative teams the clarity to connect inspiration with impact, turning «I think» into «I know,» and «This feels right» into «This truly resonates.»

The best brands aren’t built on broadcasting alone. They’re shaped through conversation—by speaking, yes, but also by listening. By staying open to what the world reflects back. In a world where brands are constantly shouting for attention, the one that listens first is the one that stands out. Because only those who listen can say something worth hearing.